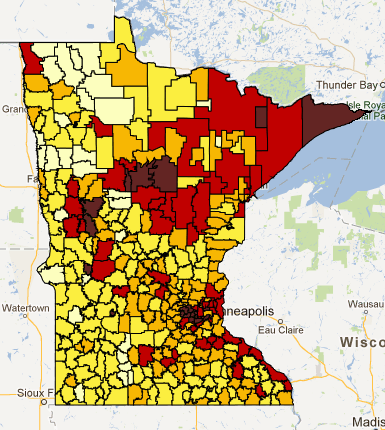

MREA released a today showing the taxpayer effort to raise $1,845 in operating revenue per pupil (RMCPU) in Minnesota. At $1,845 voter approve operating referendum revenue, all the school districts that require above average taxpayer effort are rural Minnesota school districts. The $1,845 represents the current “cap” or maximum allowable referendum per resident pupil applicable to most Minnesota school districts. A thumbnail is below. View the interactive map by clicking here.

The 21 districts with the lowest tax effort:

- Average $180 in tax effort on $150,000 home to raise $1,845 per pupil referendum

- Average $1,264 in referendum per resident pupil

The 31 districts with the highest tax effort:

- Average $1,002 in tax effort on $150,000 home to raise $1,845 per pupil referendum: 550 percent of the lowest tax effort school districts

- Average $1,170 in referendum per resident pupil: 93 percent of the lowest tax effort districts

- All of these districts are rural school district

- Average referendum for FY ’13 is $1,035 per ADM (Average Daily Membership)

The levels of tax effort in this map are defined as 20 percent of the variation in tax effort $’s required to raise $1,845 in referendum regardless of the number of districts in each effort quintile.

Minnesota equalizes the up to $1,358.24 (26% of $5,224—the basic formula) of referendum revenue per resident pupils in two tiers of districts’ referendum market value per pupil: $476,000 and $270,000 called factors. The range in effort up to a $1,358 referendum can be reduced by increasing theses equalizing factors, or increasing the level of referendum eligible for equalization. That will affect referendums that exceed $1,358.

More Maps

MREA also released a map representing an increase to $1,000. View the map and summary of the $1,000 per pupil by clicking here.