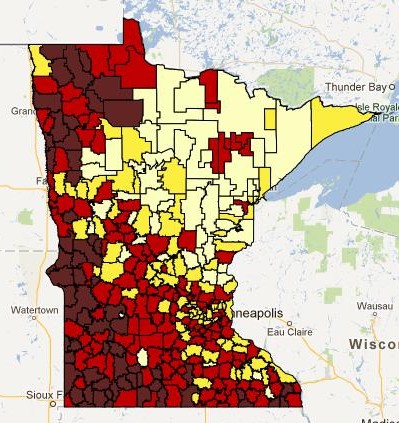

MREA released a map today showing the tax relief and equalization or EAR. Education Enhancement Revenue (EAR) – SF 177 as amended- provides, Tax Relief, Tax Equalization, and Closing the 5th to 95th Gap in Funding per Student. A thumbnail is provided below. View this interactive map by clicking here.

What does EAR do?

- Provides a base $300 per student levy which school boards can under levy

- Establishes a EAR Equalization Factor of $952,000 RMV per student which is double the current 1st Tier Factor of $476,000

- Increases the 1st Tier Factor to $880,000 and the 2nd Tier to $440,000 (up from $270,000

EAR in tax impact on homeowners:

- Provides all taxpayers in school districts with voter approved operating referendums tax relief.

- Provides the greatest tax relief (up to 25% of operating referendum taxes) in those areas with higher tax effort and higher operating referendums View a map showing impact of raising $1,000 per pupil. View impact of raising to cap of $1,845 per pupil.

- Establishes a uniform base EAR levy at .0315% for 98% of Minnesota’s school districts including the 54 schools which have less than $300 operating referendum. (Only a handful of districts have more than $952,000 RMV per pupil.)

The school boards in those 54 districts will be able to generate equalizing revenue for their students up to $300 per pupil. The tax impact will be a uniform $47.50 on a $150,000 home in those districts if all the school boards levy the full amount for the education of the youth of the community.