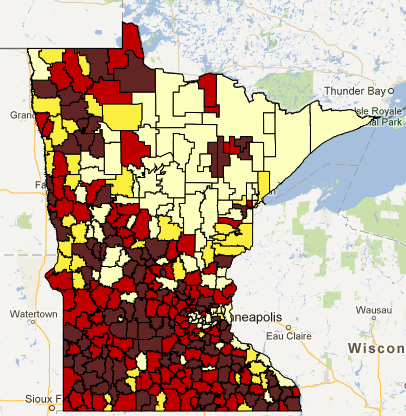

MREA released map today showing the tax relief and equalization in SF 453. A thumbnail is below. View the interactive map.

SF 453 replaces nearly $34 million in Operating Referendum Levies with State Equalization dollars:

- Raises Tier 1 Equalization Factor to $586,000, a 13% increase

- Lowers Tier 2 Equalization Factor to $259,000, a 4% decrease

SF 453 Tax Impact on Homeowners:

- Provides homeowners in the 253 school districts with voter approved operating referendums tax relief which also have less than $586,000 in RMV/PU.

- Provides the greatest tax relief up to $25.50 for $150,000 homes in districts with greater than $270,000 in RMV/PU with referendums of $700 or more

- Provides 40% of that relief ($10.50 for $150,000 homes) for the lowest wealth school districts with referendums of $700 or more